EASTON, MD - A controversial ballot measure on whether to extend Talbot County's ability to raise taxes for public safety has been decided, with results finalized Friday evening.

The measure, known as Question A, asked voters if they supported continuing a tax amendment originally approved in 2020. Under this amendment, one cent of every $100 in Assessed value of property taxes is directed toward emergency services, including local fire departments and other critical public safety initiatives. On the ballot, the Charter Amendment would extend the County Council's authority to raise revenues above the revenue cap as aforesaid for an additional seven fiscal years.

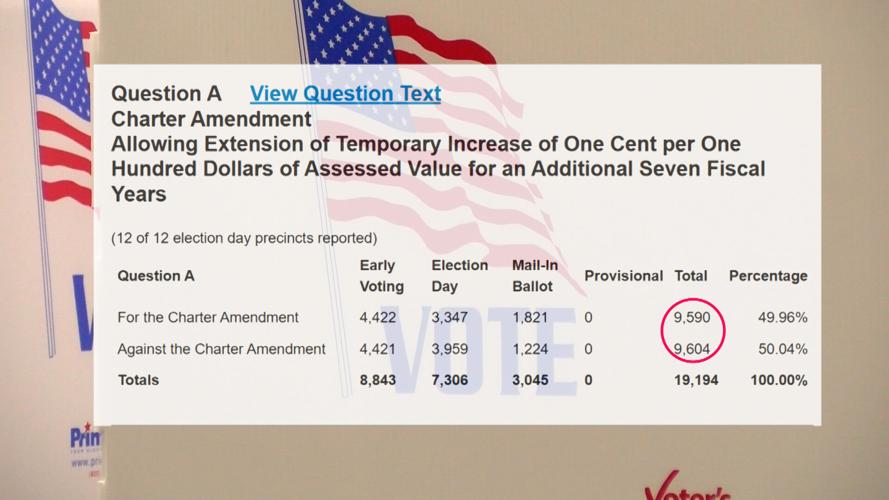

After election day, early results showed a slight majority of voters opted against extending the amendment.

Talbot County Finance Director Martha Sparks explained that the tax amendment is designed to help the county meet growing demands in public services.

"Talbot County has a revenue cap that is built into their charter. And that revenue cap makes it very challenging for the county to meet its operational and capital needs. Specifically, to be competitive with other counties in personnel, and it was really starting to impact our emergency services and our public safety," Sparks said.

Residents were divided on the issue. Hugh Smith, a Talbot County resident who opposed Question A, felt the county was adequately funded.

"We enjoy really good emergency services right now, and when I voted against Question A, I just didn't feel that the county needed any more revenue given the excellent state of infrastructure they have now," Smith said.

In contrast, resident Chris Rigaux supported the amendment, citing visible improvements in local emergency resources.

"I mean, you see a lot more defibrillators around town and a lot more emergency stations set up, like Idlewild Park. You pick up the phone, and somebody actually answers it," Rigaux said.

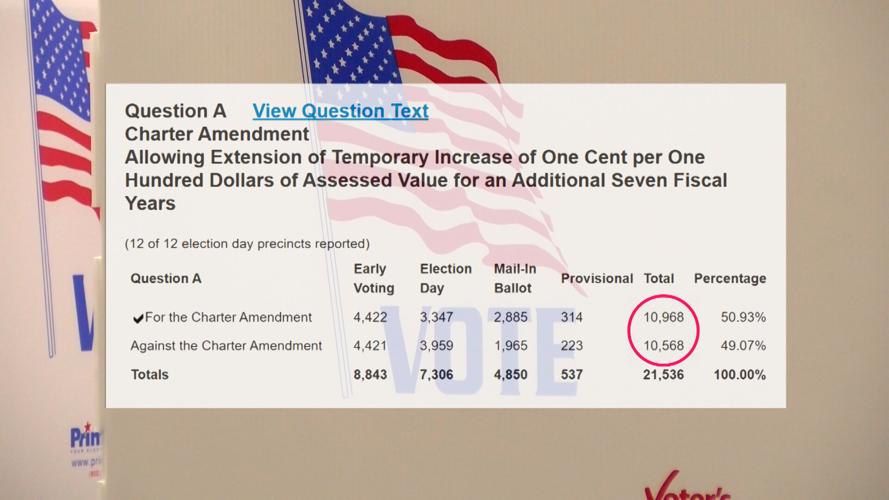

After election day, 14 votes separated the two sides, withthose opposing the measure holding the lead. However, approximately 1,600 mail-in ballots needed to be counted.

After all mail-in ballots were counted, the results showed that the measure passed by a margin of about 400 votes, ensuring the continuation of the one-cent tax amendment for another seven fiscal years.

Residents remain divided on the outcome, with some expressing relief at the amendment's passage while others voiced ongoing concerns about the county's spending priorities.

"Because the tax rate has always been lower in Talbot County than in surrounding counties—that's my understanding—and I think we need to support emergency services," said Debbie Mandycz, an Easton resident who supported the amendment.

In contrast, some residents criticized the need for additional revenue. Smith spoke with us again Monday afternoon and said, "There seems to be plenty of money around; the county just built pickleball courts and a gymnasium out of the Talbot County Community Center. So they seem to have money to carry out projects without ballot initiatives."

Terry Baker, another resident, expressed frustration, adding, "It's a trying time with how money is and how expensive things are. Let's work on those things before you start raising my taxes again."

The additional seven-year Charter amendment will begin in July 2026 and will continue until June 2033.