The Biden White House wants voters to know its differences with Republicans over taxes. The White House's National Economic Council Director, Lael Brainard, is to deliver remarks Friday on the 2017 income tax cuts that are set to expire after next year. The expiration of the tax cuts creates a challenge for the winner of November's presidential election. Brainard says President Joe Biden's policies would make the tax code fairer by raising taxes on the wealthy and corporations that avoid paying what they owe. Former President Donald Trump says higher taxes would wreck the economy.

Search / 54 results found Showing: 1-10 of 54

FILE - A sign outside the Internal Revenue Service building is seen, May 4, 2021, in Washington. The IRS said Thursday, May 2, 2024, it's taken steps to address a wide disparity in audit rates between Black taxpayers and others filers. And the agency is more closely examining the returns of larger numbers of wealthy people and major companies. The IRS says in an annual report that it's overhauling compliance efforts as it strives to “hold ourselves accountable to taxpayers we serve.” (AP Photo/Patrick Semansky, File)

Some Kansas lawmakers see a chance to lure Kansas City’s two biggest professional sports teams across the Missouri border, but an effort to help the Super Bowl champion Chiefs and Major League Baseball’s Royals finance new stadiums in Kansas fizzed. Kansas legislators worried about how it might look to taxpayers. Members of the Republican-controlled Legislature pushed a bill Tuesday that would have allowed Kansas officials to authorize at least $1 billion in bonds to cover the entire cost of building each new stadium. But GOP leaders didn’t bring it up for a vote before lawmakers adjourned their annual session early Wednesday.

In a meeting this week, the Lewes City Council proposed a new 3% local hotel lodging tax and proposed raising the current Gross Receipts Rental Tax for short-term rentals from the current 5% to 6%.

The IRS says more than 140,000 taxpayers filed their taxes through its new direct file pilot program. It says the program’s users claimed more than $90 million in refunds and saved roughly $5.6 million in fees they would have spent with commercial tax preparation companies. But despite what IRS and Treasury Department officials said Friday is a successful rollout, they don’t guarantee the program will be available next year for more taxpayers. They say they need to evaluate the data on whether building out the program is feasible. The government pilot program rolled out this tax season allowed certain taxpayers in 12 states to submit their returns directly to the IRS for free.

FILE - The Internal Revenue Service 1040 tax form for 2022 is seen on April 17, 2023. The IRS said Friday, April 26, 2024, more than 140,000 taxpayers filed their taxes through its new direct file pilot program. It says the program's users claimed more than $90 million in refunds, saving roughly $5.6 million in fees they would have spent with commercial tax preparation companies. (AP Photo/Jon Elswick, File)

Several Eastern Shore lawmakers gathered today at the Civic Center for the annual post-General Assembly session wrap-up forum hosted by the Salisbury Area Chamber of Commerce.

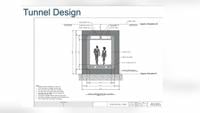

DOVER, Del.- A legislative committee has given the green light to construct a private tunnel linking a planned parking garage to Legislative H…

Canadian Prime Minister Justin Trudeau is imposing higher taxes on the wealthiest Canadians as part of the federal government. The budget proposes to increase the capital gains inclusion rate, which refers to the taxable share of profit made on the sale of assets. The taxable portion of capital gains above $250,000 Canadian would rise from half to two-thirds, which the federal government says will only affect 0.1% of Canadians. Trudeau's Liberal government is trailing badly in the polls amid concerns over the cost of living in Canada.

Canada's Prime Minister Justin Trudeau, left, Deputy Prime Minister and Minister of Finance Chrystia Freeland are joined by cabinet ministers for a photo before the tabling of the federal budget on Parliament Hill in Ottawa, Ontario, on Tuesday, April 16, 2024. (Justin Tang/The Canadian Press via AP)